For any kid, getting a doll fashioned after a Disney princess is a rite of passage.

Whether it’s Moana or Cinderella, Snow White or Elsa, the entertainment giant has long leveraged its intellectual property for consumer product dominance, with toys and products geared toward kids and families being its pedigree.

Now, The Hollywood Reporter has learned that the company is planning to take that ethos and bring it upscale: Disney wants to carve out a larger piece of the high-end market, entering new categories and crafting luxury and fashion-forward versions of some of its Princess staples.

“The Disney Princess brand has become one of our most powerful global franchises, and we’re accelerating its evolution,” Paul Gitter, executive VP of global brand commercialization for Disney Consumer Products, tells THR. “We’re intentionally expanding globally and moving Princess into lifestyle‑driven categories — beauty, fashion, fine jewelry, home décor — that drive financial returns and extend these stories far beyond the screen, meeting fans in culturally relevant spaces.”

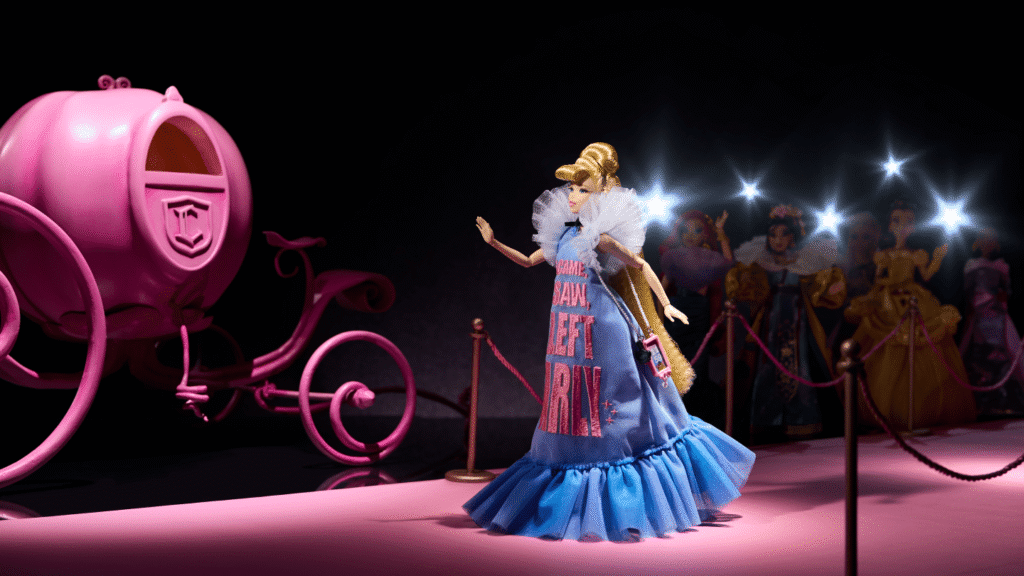

For a taste of what to expect, consider the latest addition to the product line: A partnership between Disney, Mattel and the avant-garde couture house Viktor&Rolf to create a new Cinderella doll that is most definitely not geared toward children.

The doll will launch during Paris Fashion Week, with only a limited number of units available.

“This project was really special because it was an opportunity to merge three creative forces — Disney’s storytelling legacy, Mattel’s masterful craftsmanship, and Viktor&Rolf’s fashion imagination,” says Viktor Horsting and Rolf Snoeren, founders of Viktor&Rolf. “The result is a collectible that not only celebrates a beloved character, but also it invites entirely new audiences into the world of Disney, including fashion enthusiasts and modern collectors who appreciate cultural expression through design.”

“Collaborations like Viktor&Rolf signal a new design‑led direction for the Disney Princess brand — one that attracts new audiences, fuels premium growth, and builds momentum long after a film leaves theaters,” adds Gitter. “This strategy isn’t just expanding categories; it’s redefining what a modern franchise can be. And it’s just the beginning — part of a deliberate approach Disney has built to ensure our characters grow with the culture through meaningful creative partnerships.”

The company is hard at work identifying licensees that will expand the reach of the Disney Princess brand, while staying true to Disney’s own brand and the characters it houses.

“Our strategy starts with asking how a specific Disney property — be it an individual character like Disney’s Cinderella, or a broader theme — can authentically translate into a product or experience,” says Gitter. “For Disney Princess, this means balancing iconic character-driven design with storytelling elements that resonate across generations. Collaborations like the Viktor&Rolf x Disney Collector Cinderella doll allow us to reimagine a classic character in a fresh light, while staying true to the values and emotional touchpoints that make her so beloved. We work closely with licensees to ensure that character integrity and story come first, no matter the category.”

Indeed, while a doll geared more toward collectors rather than kids is not exactly an entirely new idea, it is a good example where Disney plans to shift its Princess brand, supplementing its core product lines with new offerings that are decidedly upscale, from the Bath & Body Works Disney Princess Collection (or the new Disney Villains collection), to a new Disney and Pandora Princess collection featuring lab-grown diamonds. And suffice it to say, jewelry, high-end fashion, home decor and collectibles carry better margins than traditional toys and apparel.

“Our expansion into premium categories — luxury fashion, fine jewelry, and beauty — complements our toy business and reflects how today’s fans want to express their connection to these stories,” says Gitter. “These categories allow us to reach new audiences, drive financial returns, and ensure the Princess brand stays both culturally impactful and commercially strong, well beyond theatrical windows. The market potential is substantial, as we continue to engage fans of all ages — from young girls and collectors to nostalgic adults — across every tier of retail.”

And the company has also been expanding in an area it knows well: Experiential entertainment. While families have been meeting princesses at Disneyland, Walt Disney World and at Disney parks and cruise ships for decades, it has also been exploring ways to bring those characters to life in other ways.

In London, the company has the Disney Princess Afternoon Tea — hosted at the Park Corner Brasserie inside the London Hilton on Park Lane, with character-themed dishes and interactive elements that make them feel like part of the royal story; and in 2024, Disneyland Paris hosted the runway during Fashion Week for French label Coperni.

Disney says that Moana will be a focal point, with the live-action adaptation of the film set for release later this year, as it explores other venues to expand the Princess brand.

“Product has become a powerful entry point into the Disney ecosystem — not just an extension of it,” says Gitter. “We have products at every level of retail — from value to luxury. And, while Disney’s retail portfolio spans more than 100 categories in 180 countries, there is always opportunity to build deeper connections in emerging and lifestyle-driven spaces, especially areas like luxury fashion, premium experiential, home décor, collectibles, digital content and more across the globe. Our evolving strategy is about meeting fans where trends are taking shape, and that sometimes means piloting new retail collaborations in sectors where our brand’s storytelling power can drive meaningful engagement and growth.”

There is no other studio with the experience of adapting its film IP in more places than Disney. From theme parks to products, live theater to cruise ship pubs, Disney is a master at taking family franchises and making them truly cross-generational (look no further than Stitch from Lilo & Stitch, who was arguably the company’s biggest star last year).

But the company has no plans to abandon its kids and family roots. Instead, the expansion of Disney Princess upmarket is meant to follow the kids as they grow up, and to bring some of the magic and fashion that is inherent in the princess stories to categories more relevant to adults.

“Disney Princess is a multi-generational brand by design. Our portfolio is deliberately structured to serve different audiences, from toys and everyday essentials for families and kids to premium collaborations and collectibles for adult fans and collectors,” Gitter says. “We see a ‘halo effect’ from this structured approach. Premium partnerships drive excitement and relevance across the brand, while core toy and mass-market lines continue to thrive. No matter the category or price point, every product is created to be authentic, inclusive, and true to the enduring values of the Princess brand, offering meaningful connections for new fans and nostalgic ones alike.”

Read the full article here