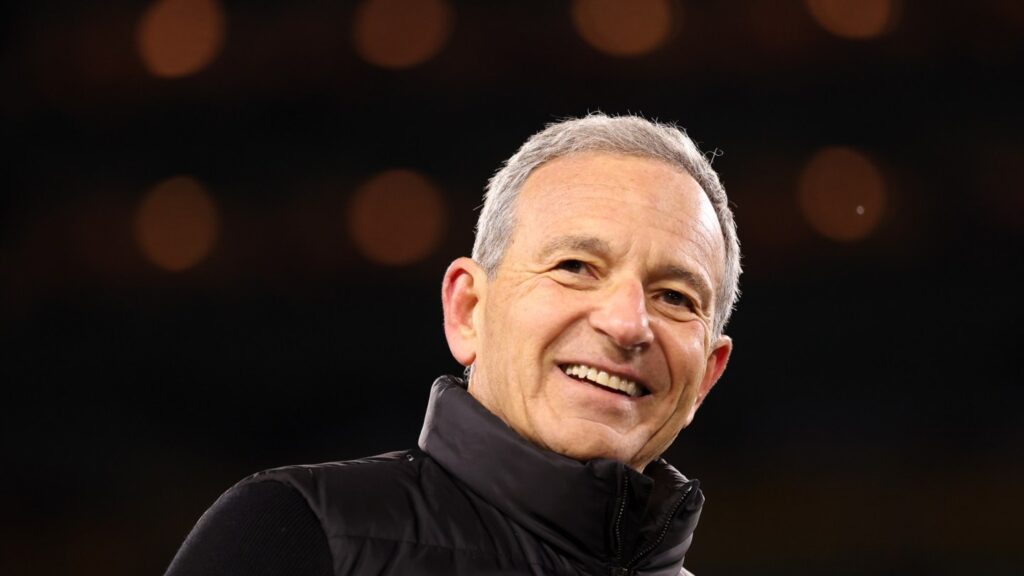

With a succession decision expected in the very near future, The Walt Disney Co. delivered a Wall Street beat in its latest quarter, a hard-earned win and perhaps even a sendoff for CEO Bob Iger, who is widely expected to step aside in the coming months, ahead of his end of 2026 contract expiration (Josh D’Amaro, Disney’s experiences chairman, is seen as the internal favorite to succeed him).

It is not clear whether Iger will stay with the company in some other capacity like with a board seat after he steps aside as CEO.

“We are pleased with the start to our fiscal year, and our achievements reflect the tremendous progress we’ve made,” Iger said in a statement tied to earnings. “We delivered strong box office performance in calendar year 2025 with billion-dollar hits like Zootopia 2 and Avatar: Fire and Ash, franchises that generate value across many of our businesses. “As we continue to manage our company for the future, I am incredibly proud of all that we’ve accomplished over the past three years.”

Disney delivered revenue of $26 billion in the quarter, its fiscal Q1, with segment operating income of $4.6 billion and adjusted earnings per share of $1.63. The street had projected revenue of $25.6 billion and adjusted EPS of $1.58.

A strong film slate in the quarter and a streaming business that continues to grow bolstered Disney’s entertainment division, while experiences delivered record revenues and operating income.

Entertainment revenues were $11.6 billion, with operating income of $1.1 billion, an increase of 7 percent and a decline of 35 percent year-over-year, with the YouTube TV blackout and higher costs offset by a strong theatrical slate and improvements in streaming. The success of the latest Avatar film will also flow into the current quarter.

Streaming revenues were $5.3 billion, with operating income of $450 million, up substantially from a year ago. Fiscal Q1 was the first quarter in which Disney stopped disclosing streaming subscriber numbers. The company ended its last quarter with 132 million Disney+ subscribers, and 196 million Disney+ and Hulu subscribers, with revenue growth this quarter suggestive of further adds, perhaps paired with higher prices.

Experiences revenues cracked $10 billion, with operating income of $3.3 billion, as guests spent more and with Disney’s cruise ships operating at a higher capacity.

In sports, revenues were $4.9 billion, with operating income of $191 million.

According to Disney’s 10-Q, the company closed its deal for the NFL to acquire a 10 percent stake in ESPN in January, a deal that carries an estimated fair value of $3 billion, per the company. Disney also disclosed that it has the right to buy back the NFL’s stake beginning in July 2034, “in exchange for a ten-year note at 70 percent of the then fair market value of the NFL’s interest in ESPN,” while the league has an option to acquire an additional 4 percent of ESPN at 70 percent of fair market value.

That said, there were also some cracks showing. The extended YouTube TV blackout of Disney’s channels, most notably ABC and ESPN, had an adverse impact on operating income of $110 million, and was reflected in the sports division, which saw operating income decline 23 percent compared to last year.

And while the company reaffirmed its guidance, it warned of higher costs at experiences due to new attractions and cruise ships, as well as “international visitation headwinds at our domestic parks.”

In entertainment, the company projects segment operating income in its fiscal Q2 to be comparable to a year ago, while streaming income is expected to rise to $500 million. For the year, the company projects double digit operating income growth in the segment, weighted to the second half, and streaming margins of 10 percent.

Sports is expected to have low single digit operating income growth for the year, with a slight decline in Q2 due to higher expenses.

And while experiences is expected to have modest operating income growth in fiscal Q2, the company still projects high single digit growth, weighted toward the back half of the year.

Read the full article here